Pada hari Selasa, pasangan mata uang GBP/USD trading lebih rendah, tetapi penurunannya lemah, sama seperti volatilitasnya. Lihat saja pergerakan terbaru GBP/USD! Bisakah kita mengatakan pasar lelah menjual dolar dan bersiap untuk koreksi serius? Pound Inggris masih tumbuh karena alasan apa pun—atau tanpa alasan sama sekali. Dan ketika pasar tidak menemukan alasan untuk membuka posisi beli baru, pasar hanya berhenti dan menunggu berita. Dan berita untuk dolar, sayangnya, lebih banyak negatif daripada positif. Namun, penting untuk membedakan elemen yang berharga dari yang tidak berharga dalam situasi ini. Ada dan masih ada berita positif untuk dolar. Misalnya, kebijakan moneter Federal Reserve tetap hawkish pada tahun 2025, tidak seperti Bank of England yang sudah dua kali menurunkan suku bunga, dan tidak seperti European Central Bank yang menurunkan suku bunga di setiap pertemuan.

Tetapi tidak ada faktor-faktor ini yang menarik minat para trader saat ini. Mereka hanya tertarik pada Trump dan keputusannya tentang isu-isu besar dan global—seperti kebijakan perdagangan. Dan di sini, ada sangat sedikit berita positif untuk dolar AS. Begitu tanda-tanda de-eskalasi dalam konflik perdagangan muncul, dolar setidaknya berhenti jatuh setiap hari. Selama sebulan, mata uang AS trading mendatar terhadap pound dan sedikit menguat terhadap euro. Namun, begitu Trump mulai "memicu konflik" lagi dengan Uni Eropa dan China, memberlakukan tarif baru dan menaikkan tarif lama, dan sistem peradilan AS mengalami keruntuhan, dolar melanjutkan penurunannya.

Seperti yang kami katakan dalam artikel sebelumnya tentang euro, target utama Trump adalah China dan Uni Eropa. China telah tumbuh dan berkembang terlalu cepat dalam beberapa tahun terakhir dan menimbulkan ancaman nyata bagi AS untuk kepemimpinan global. Uni Eropa adalah wilayah yang sangat kaya dari mana banyak uang dapat diekstraksi. Mengapa tidak memanfaatkan itu? China juga dapat dipaksa untuk membayar lebih karena "terus-menerus mencuri" teknologi AS dan mendapatkan keuntungan dari pasar Amerika dengan menjual sejumlah besar barang di sana. Selain itu, banyak barang Amerika diproduksi di China. Jadi, Trump memutuskan "domba-domba" ini perlu "dicukur" sedikit.

Apa yang akan terjadi masih harus dilihat. Brussels dan Beijing juga tidak dijalankan oleh orang bodoh. Mereka sepenuhnya memahami apa yang Trump coba capai dan apa yang dia tuju. Trump hampir tidak tertarik pada negosiasi dan kesepakatan perdagangan dengan negara-negara kecil yang perputarannya hanya beberapa miliar dolar. Tentu, konsumen Amerika harus membayar tarif untuk barang-barang Hungaria atau Serbia, ekspor dari negara-negara ini akan menyusut, dan ekonomi mereka akan menderita—tetapi apa manfaatnya bagi AS? Dan omong-omong, konsumen Amerika akan membayar semua tarif terlepas dari hasilnya. Pemerintah AS yang akan mendapatkan keuntungan. Dan untuk menjaga agar orang Amerika tidak terlalu mengeluh, pajak akan diturunkan—tentu saja, jauh lebih sedikit daripada yang akan "dimakan" oleh tarif.

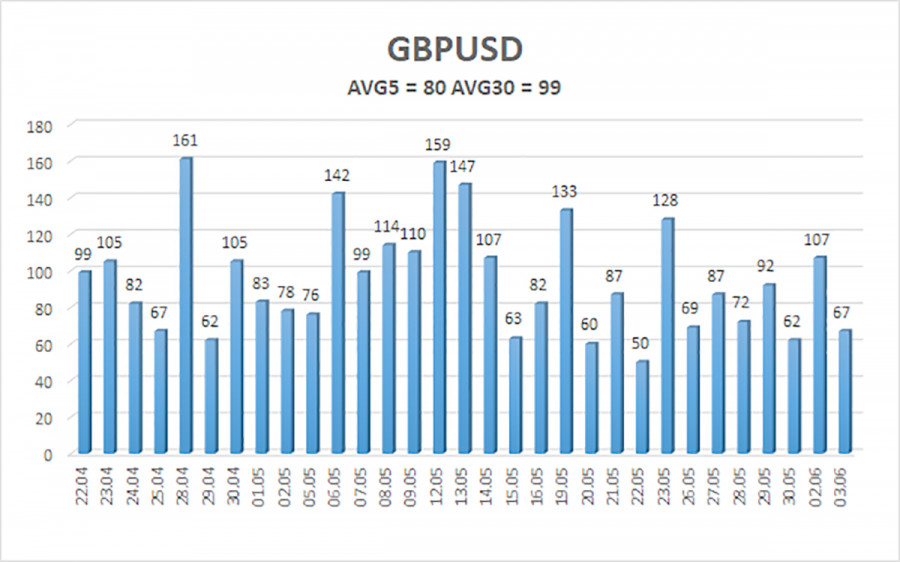

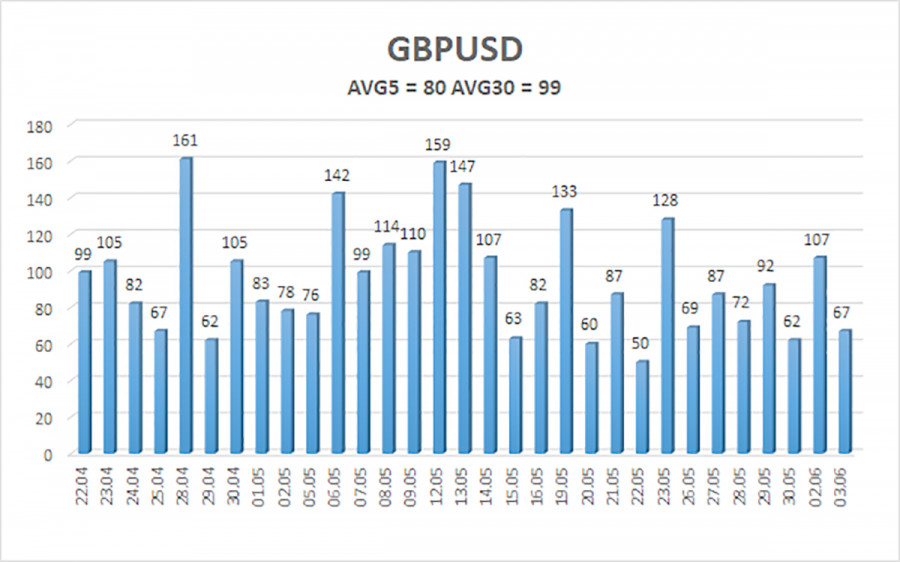

Rata-rata volatilitas pasangan GBP/USD selama lima hari perdagangan terakhir adalah 80 pips, yang dianggap "moderat" untuk pasangan pound/dolar. Pada hari Rabu, 4 Juni, kami memperkirakan pasangan ini akan bergerak antara 1.3445 dan 1.3605. Saluran regresi jangka panjang mengarah ke atas, menunjukkan tren naik yang jelas. Indikator CCI belum memasuki zona ekstrem baru-baru ini.

Tingkat Dukungan Terdekat:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Tingkat Resistensi Terdekat:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Rekomendasi Trading:

Pasangan GBP/USD mempertahankan tren naik dan terus meningkat. Ada banyak berita yang mendukung pergerakan ini. De-eskalasi konflik perdagangan berakhir secepat dimulai, tetapi ketidaksukaan pasar terhadap dolar tetap ada. Setiap keputusan baru dari Trump—atau apa pun yang terkait dengan Trump—dipersepsikan negatif oleh pasar. Oleh karena itu, posisi panjang tetap memungkinkan dengan target di 1.3605 dan 1.3672 jika harga tetap di atas moving average. Konsolidasi di bawah moving average akan memungkinkan posisi pendek dengan target di 1.3428 dan 1.3306. Tapi siapa yang mengharapkan reli dolar yang kuat saat ini? Sesekali, dolar mungkin menunjukkan koreksi kecil, tetapi pertumbuhan substansial memerlukan tanda-tanda nyata de-eskalasi perang dagang.

Penjelasan Ilustrasi:

Saluran Regresi Linear membantu menentukan tren saat ini. Jika kedua saluran sejajar, ini menunjukkan tren yang kuat.

Garis moving average (pengaturan: 20,0, smoothed) mendefinisikan tren jangka pendek dan memandu arah trading.

Level Murray bertindak sebagai level target untuk pergerakan dan koreksi.

Level Volatilitas (garis merah) mewakili rentang harga yang mungkin untuk pasangan ini selama 24 jam ke depan berdasarkan pembacaan volatilitas saat ini.

Indikator CCI: Jika memasuki wilayah oversold (di bawah -250) atau overbought (di atas +250), ini menandakan pembalikan tren yang akan datang ke arah yang berlawanan.