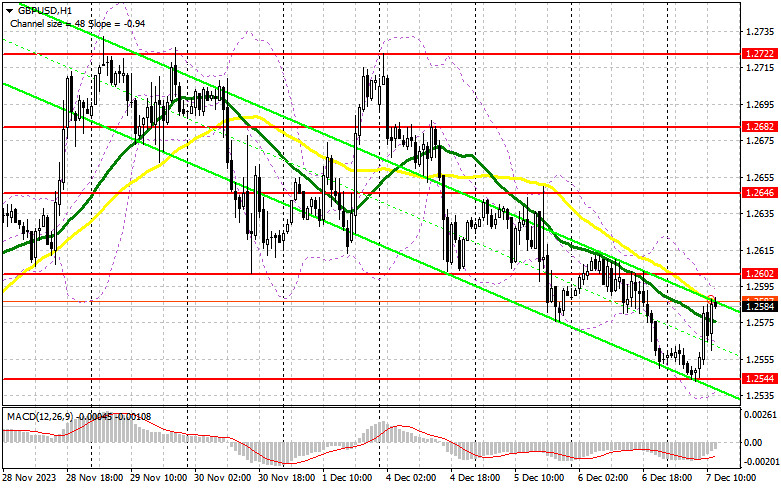

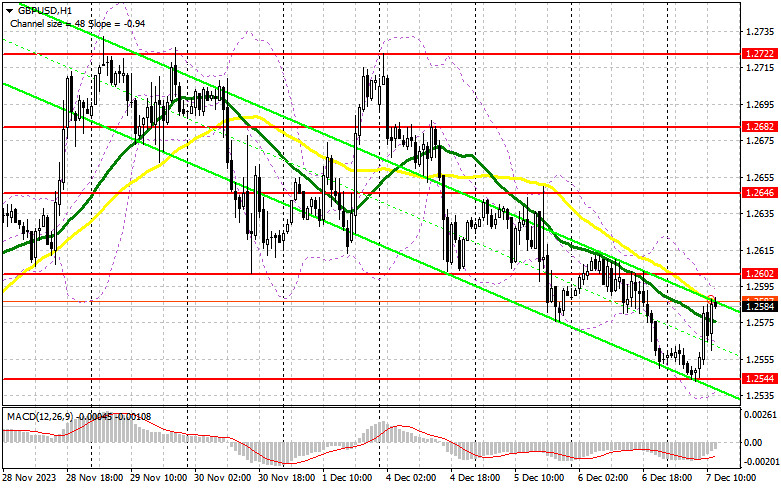

In my morning forecast, I drew attention to the level of 1.2575 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. Growth and the formation of a false breakout led to a sell signal for the pound, but a significant drop in the pair did not occur. After a 10-point downward movement, demand for the pound returned, leading to profit-taking. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD, it is required:

Considering the weak reaction of sellers to the correction, it is evident that substantial reasons are needed for the return of major bears to the market. Whether today's US labor market data will be such reasons – I strongly doubt it. A weekly decrease in the number of initial jobless claims and changes in wholesale trade inventories is unlikely to be a serious reason for selling the pound. On the other hand, there is nothing else to rely on that could keep trading within a sideways channel. I plan to act on buying only after a decline and the formation of a false breakout around the weekly low of 1.2544. This will provide a good entry point with the prospect of movement to the area of 1.2602, just below which the moving averages are located, playing on the sellers' side. A breakout and consolidation above this range will bring demand for the pound back and open the way to 1.2646. The ultimate target will be the area of 1.2682, where I will take profit. In the scenario of the pair's decline in the second half of the day and the absence of bull activity at 1.2544, trading will remain within the framework of a new descending channel. In this case, only a false breakout around the next support at 1.2511 will signal the opening of long positions. I plan to buy GBP/USD immediately on a rebound only from 1.2478, with a correction target of 30-35 points within the day.

To open short positions on GBP/USD, it is required:

Sellers control the market, and their only concern is protecting the nearest resistance at 1.2602. I plan to sell only after the formation of a false breakout there, which will allow a downward movement to the weekly low of 1.2544. However, only a breakout and a reverse test from the bottom to the top of this range will deal a more serious blow to the bull positions, leading to the removal of stop orders and opening the way to 1.2511. The more distant target will be the area of 1.2478, where I will take profit. Testing this level will only strengthen the bearish trend. In the scenario of GBP/USD growth and the absence of activity at 1.2602 in the second half of the day, buyers will gain an advantage and try to regain market control. In this case, I will postpone sales until a false breakout at 1.2646. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.2682, but only expecting a pair correction down by 30-35 points within the day.

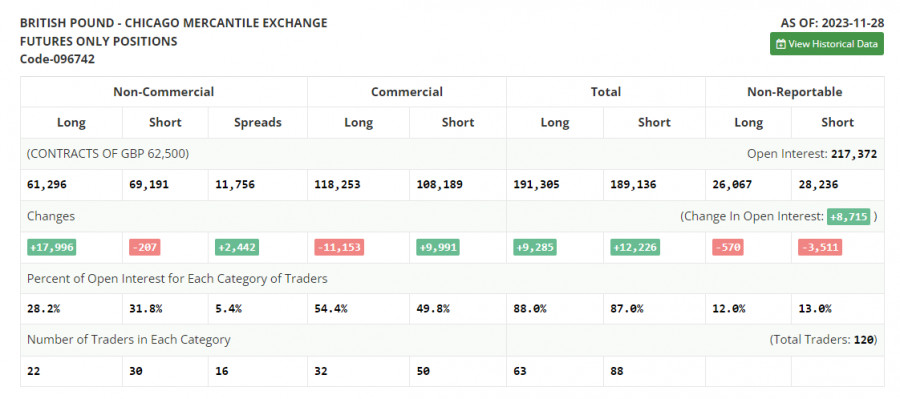

The COT report (Commitment of Traders) for November 28 showed a sharp increase in long positions and a slight reduction in short positions. Demand for the pound persists, as the Governor of the Bank of England, Andrew Bailey, states that if the regulator does not continue to raise interest rates, it will at least maintain them at current highs for quite a long time, helping attract new buyers to the market. Add to this the dovish rhetoric of Federal Reserve System representatives and its chairman, Jerome Powell, and it becomes clear why the pound may continue to rise soon. Important labor market statistics related to the US will be released soon, which will clarify the situation. The latest COT report states that non-commercial long positions increased by 17,996 to 61,296, while non-commercial short positions decreased by 207 to 69,191. As a result, the spread between long and short positions increased by 2,442. The weekly price rose and reached 1.2701 against 1.2543.

Indicator Signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating issues with the British pound.

Note: The author considers the period and prices of moving averages on the hourly chart (H1) and differs from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decrease, the lower boundary of the indicator, around 1.2540, will act as support.

Description of Indicators:

- Moving Average (MA): Defines the current trend by smoothing volatility and noise. Period 50. Marked on the chart in yellow.

- Moving Average (MA): Defines the current trend by smoothing volatility and noise. Period 30. Marked on the chart in green.

- Moving Average Convergence/Divergence (MACD): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Non-commercial Long Positions represent the total long open position of non-commercial traders.

- Non-commercial Short Positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.