On Monday, the EUR/USD currency pair remained immobilized. There were no updates over the weekend from Donald Trump regarding trade developments, and no important data or events were scheduled for Monday. Therefore, the market had nothing to react to during the day. However, the EUR/USD pair has already been trading within a sideways channel for three weeks. Over the past few days, volatility has also declined significantly. Nevertheless, one should not conclude that the market has calmed down — instead, the market is waiting. Few believe that Trump will refrain from raising or introducing new tariffs. Already, reports have surfaced suggesting possible tariff hikes of up to 20% for the EU. Meanwhile, China is not engaged in negotiations with the United States, which could deeply frustrate Trump, who had counted on reaching a deal within 3–4 weeks. Therefore, it is too early to speak of the end or de-escalation of the global trade war.

It must be acknowledged that many countries from "Trump's list" are negotiating with the U.S. about trade deals. However, as we stated two months ago, mainly weak countries — economically, geographically, or geopolitically — are trying to reach an agreement with the conflict-prone and "fair" U.S. president. For example, Hungary (even though it is an EU member) is eager to secure a deal. Vietnam, which faces 46% import tariffs, strives to negotiate. Talks are underway with South Korea, Japan, and several other countries. Yet this list is missing notable heavyweights like Canada, the European Union, and China.

To be precise, consultations with Brussels are ongoing, but no sign of a trade deal emerging. The market cannot be cheered by progress in talks with Vietnam. The American market and U.S. investments constitute half of Vietnam's economy. The U.S. is an important economic partner for the EU and China, but cooperation with the U.S. is far less important than it is for Vietnam. It is also important to understand that America is a competitor to the EU and China, while Vietnam is unlikely to compete with the U.S. Thus, weaker players seek agreements with Trump, while stronger ones resist and demand a fair and equitable deal.

The market is interested in progress with China and the EU. Without progress, the dollar cannot gain strength against its major competitors. Therefore, after reaching another high, the price has simply been moving sideways for three weeks. Current movements cannot be described as technical either since we barely observe any corrections. Accordingly, there is a 90% probability that market movements (or lack thereof) this week will depend solely on the U.S. president.

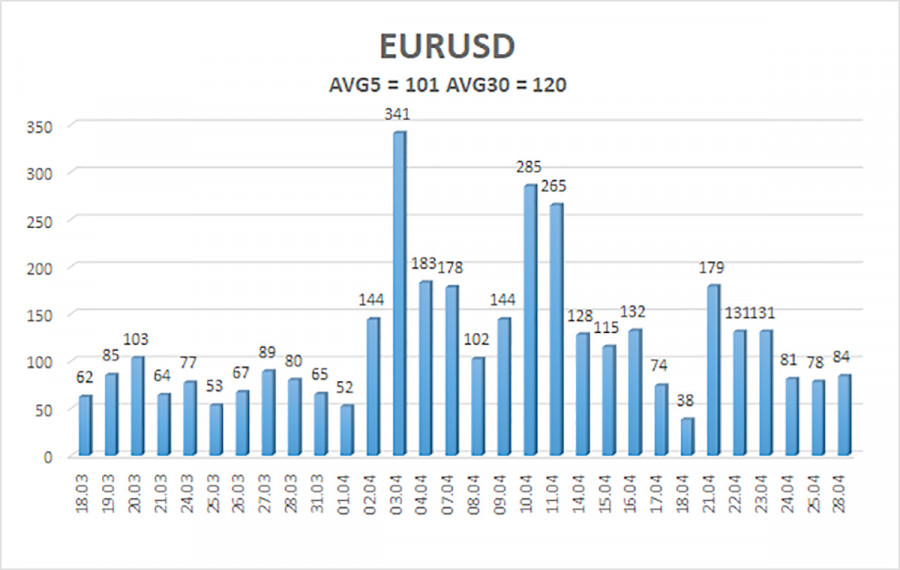

The average volatility of the EUR/USD currency pair over the last five trading days as of April 29 is 101 pips, which is considered "high." We expect the pair to move between the levels of 1.1284 and 1.1485 on Tuesday. The long-term regression channel is pointing upward, indicating a short-term uptrend. The CCI indicator has entered the overbought zone for the third time, signaling a new corrective movement phase, which, so far, is very weak — as were previous ones.

Nearest Support Levels:

S1 – 1.1230

S2 – 1.0986

S3 – 1.0742

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1719

R3 – 1.1963

Trading Recommendations:

The EUR/USD pair maintains a short-term upward bias. For months, we have consistently said that we expect the euro to decline in the medium term, and nothing has changed. The dollar still has no fundamental reasons for a medium-term fall—other than Donald Trump. Yet this single factor continues to push the dollar into an abyss while the market ignores all other factors.

If you are trading based on "pure" technical analysis or "Trump factor," long positions remain relevant as long as the price stays above the moving average, targeting 1.1719. If the price consolidates below the moving average, short positions formally become relevant with targets at 1.1230 and 1.0986 — though it is currently hard to believe in a dollar rally. In recent weeks, there have been no new developments regarding the escalation or de-escalation of the trade war, which explains the ongoing flat movement in the market.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.