The EUR/USD currency pair continued to trade sideways for most of Wednesday. There was a minor upward movement, but as a reminder, the pair has now been range-bound for three weeks, and within such a flat range, movements can be completely random. No fundamental or macroeconomic events are needed to fuel price moves within a flat; indeed, there were none on Wednesday. The Eurozone retail sales report was not worth factoring in, as it was weaker than other macroeconomic data that the market has ignored in recent weeks and months.

However, in the ongoing trade battle between China and the U.S., we are beginning to see signs of not so much de-escalation but at least a pause in escalation. A resolution or trade agreement acceptable to both sides still seems far off. Many analysts believe a deal will eventually be signed because there are no other options. We disagree. We believe Donald Trump's ultimate goal is to weaken China economically and militarily. He isn't only using America's own leverage—he's also pressuring U.S. trading partners to choose: trade freely with the U.S. or continue doing business with China.

Most people only know the general story about Trump's demands to 75 countries. Trump has repeatedly said he wants "fairness" in trade, which essentially means reciprocal tariffs. In practice, if a country imposes any import duty on U.S. goods, Trump sees his tariffs as a justified response to the unfair treatment of American products abroad.

But in reality, the U.S. has operated under this global trade system for decades. Why, for example, did Joe Biden or Barack Obama not see this as unjust? The truth is, Trump's actions are targeted solely at China. His goal is clear: shift more wealth to the U.S. and away from China. A similar approach likely applies to the EU, as Trump's harshest accusations are aimed at China and the European bloc. According to the president, both regions have been "stealing from America for years."

This weekend marks the first official meeting between U.S. and Chinese officials in Switzerland. No agreement is expected—nor is there even talk of discussing trade details. Instead, the two sides will discuss conditions to halt further escalation of the trade conflict, which has already essentially frozen trade between the two largest global economies.

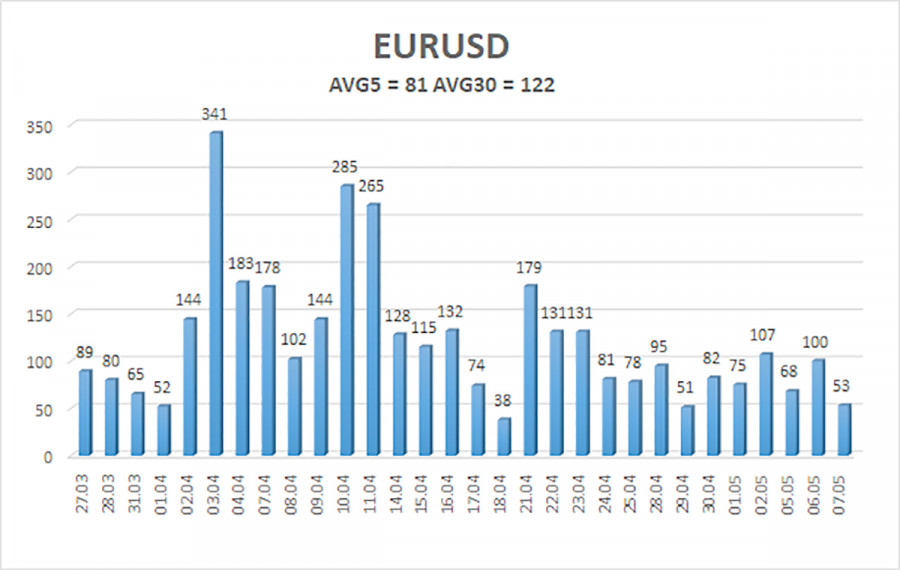

The average volatility of EUR/USD over the last five trading days stands at 81 pips as of May 8, which is classified as "average." We expect movement between 1.1259 and 1.1421 on Thursday. The long-term regression channel points upward, indicating a continued short-term bullish trend. The CCI indicator has entered the overbought zone three times recently, each time followed by only a modest correction.

Nearest Support Levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest Resistance Levels:

R1 – 1.1353

R2 – 1.1475

R3 – 1.1597

Trading Recommendations:

The EUR/USD pair has entered a new downward correction within an overall uptrend. For months, we've maintained that a medium-term decline in the euro is our base case, and that view has not changed. The U.S. dollar still has no clear fundamental reasons to weaken, except for Trump. However, this one factor alone could continue to drag the dollar downward, especially as the market ignores other data.

If you're trading based purely on technicals or reacting to Trump's moves, long positions remain relevant above the moving average, targeting 1.1475. If the price is below the moving average, shorts become relevant, with targets at 1.1259 and 1.1230. Remember that the market has been in a total flat range for the past three weeks, and that should be considered in your strategies.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.