Trade Analysis and Trading Tips for the Euro

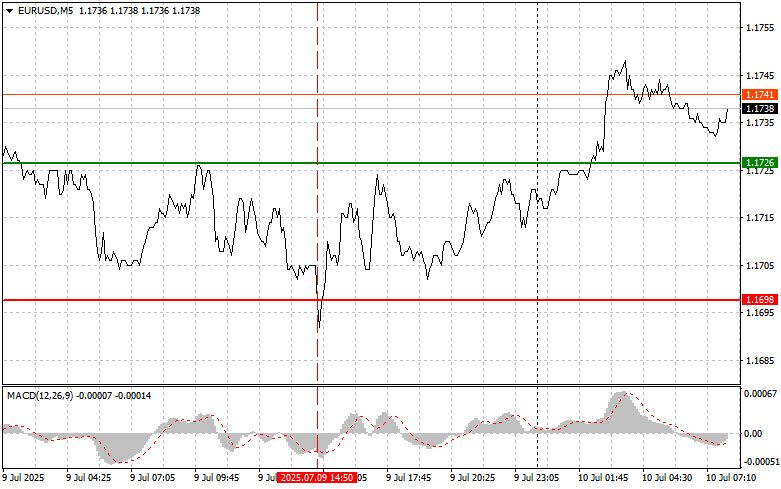

The test of the 1.1698 price level coincided with a moment when the MACD indicator had already moved significantly below the zero line, which limited the pair's downward potential. For this reason, I did not sell the euro. I did not see any other valid entry points during the day.

Wednesday ended with the pair remaining within the channel, showing no directional movement. The publication of the minutes from the latest Federal Open Market Committee (FOMC) meeting didn't offer anything new to market participants, although the document did reveal existing disagreements among Federal Reserve members regarding the future path of interest rates. Some committee members support maintaining a tight monetary policy, citing persistent inflation and the need to further slow down economic activity. Others expressed concerns about the potential for slower economic growth. They argue that the current high interest rates are already restraining business activity and investment, and further tightening could lead to undesirable consequences.

Today's focus is on Germany's Consumer Price Index (CPI) data for June and changes in industrial production in Italy. Inflation in Germany is expected to remain unchanged, so it is unlikely to significantly strengthen the euro. However, any deviation from the forecast may trigger short-term market fluctuations. A CPI reading above expectations could prompt the European Central Bank to take a more cautious stance on future rate cuts. In Italy, industrial production is a key indicator of the country's economic health. An increase in output would indicate stronger economic activity, which is a positive factor for the euro. A decline, on the other hand, would suggest a slowdown in growth and could put pressure on the common currency.

Still, it's important to note that the overall impact of these reports on the euro will be limited. The main driver of the euro remains ECB monetary policy and the broader condition of the eurozone economy.

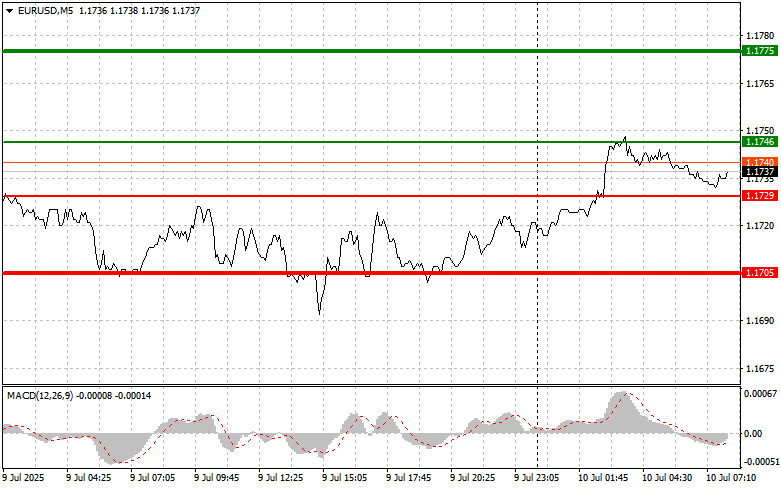

As for today's intraday strategy, I'll continue to rely on implementing Scenarios #1 and #2.

Buy Scenarios

Scenario #1: I plan to buy the euro today if the price reaches the level of 1.1746 (green line on the chart), with a target of 1.1775. At 1.1775, I intend to exit the market and consider selling in the opposite direction for a 30–35 point move from the entry level. Euro growth today is likely only if strong data are released. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if the price tests 1.1729 twice in a row while the MACD is in the oversold zone. This will limit the pair's downward potential and may lead to an upward reversal. In this case, we can expect a rise toward 1.1746 and 1.1775.

Sell Scenarios

Scenario #1: I plan to sell the euro after the price reaches 1.1729 (red line on the chart). The target is 1.1705, where I will exit the market and consider buying in the opposite direction for a 20–25 point move. Pressure on the pair may return today if the statistics are weak. Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to move down.

Scenario #2: I also plan to sell the euro if the price tests 1.1746 twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and may lead to a downward reversal. In this case, we can expect a decline toward 1.1729 and 1.1705.

Chart Explanation

- Thin green line – entry price for buying the trading instrument.

- Thick green line – target price for taking profit, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – target price for taking profit, as further decline below this level is unlikely.

- MACD Indicator – histogram and signal line. Pay attention to overbought and oversold areas when entering trades.

Important: Beginner traders on the Forex market must make decisions with great caution. Before major fundamental reports are released, it's best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you don't follow money management principles and trade with large volumes.

And remember: to trade successfully, you need a clear trading plan like the one above. Making spontaneous decisions based on short-term market movements is a losing strategy for an intraday trader.