The GBP/USD currency pair also traded higher on Monday, despite the absence of any local drivers. Let us recall that no fundamental or macroeconomic event was scheduled on the first trading day of the week. However, how can one now claim that the dollar has no reason to fall?

Donald Trump continues to do business.

If any readers are unfamiliar with the concept of "business," Donald Trump is now showing everyone how it's done. Business exists for only one purpose — to generate profit. How this is achieved is irrelevant. And Trump once again demonstrates that all tools — any trump cards — are fair game. What's the biggest trump card the U.S. has in trade? A vast and wealthy market. So why not force every country that sells goods and raw materials to the U.S. to pay for access to that market? It doesn't matter that, in reality, it's Americans who will pay. For them, tax cuts can be devised — smaller than the new tariffs, of course.

Trump doesn't care how or by whom the budget — or his own pocket — is filled. The U.S. president is now openly monetizing meetings with himself. Want to dine with the President of the United States? That'll be 300,000 dollars. And it's clear that this money won't go to the U.S. Treasury. Trump profits from everything imaginable — and wants the same from the entire country.

So when we read the news that Trump wants to raise tariffs on the European Union a bit more, there's no surprise anymore. In 2019, Trump struck a trade deal with China — and so what? Six years later, he launched a new trade war and resumed raising tariffs. Now he may sign trade deals with the EU, China, and another 70 countries — and so what? A year or two later, he could easily declare another trade war. No justification is needed. One can always say that "many countries are robbing the U.S.," or "many countries continue to rob the U.S. despite tariffs."

And for six months straight, the market has been answering the question of how it feels about Trump's policies.

Right now, no one wants to deal with the dollar. The growth of the U.S. stock market should not be misleading. American companies are not Trump. They are private businesses that focus solely on generating a profit. That's why, under Trump or any other president, investors are only concerned with a company's profitability and outlook.

However, the dollar continues to decline, and even central banks around the world are starting to shift away from using the U.S. dollar as a reserve currency. If once the dollar was a pillar of stability, now it's better to deal with almost any other currency. Therefore, we believe that the dollar's decline is far from over. The dollar rose for 16 consecutive years, and it's been falling for only 6 months now. We may be merely at the beginning of a new global trend.

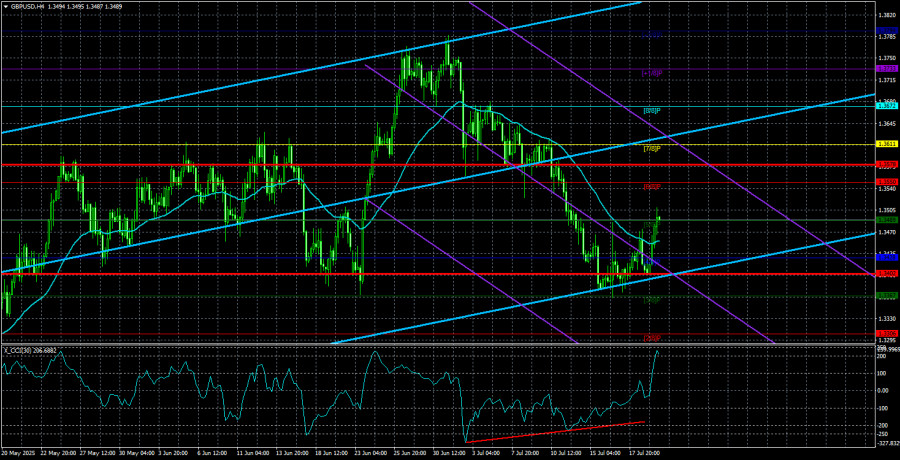

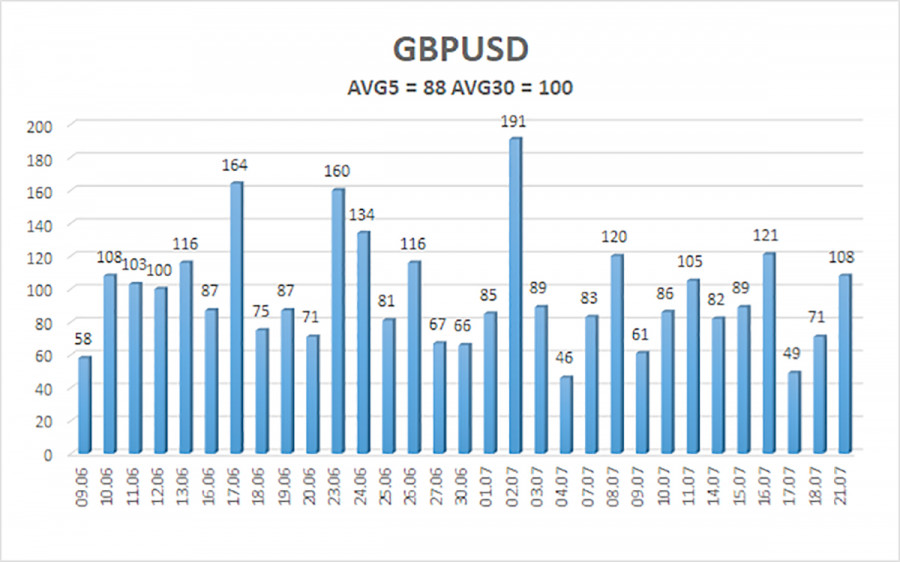

The average volatility of the GBP/USD pair over the last five trading days is 88 pips, which is considered "moderate" for this pair. On Tuesday, July 22, we expect the pair to move within a range limited by the levels of 1.3402 and 1.3578. The long-term linear regression channel is pointing upward, clearly indicating a bullish trend. The CCI indicator has entered oversold territory twice, signaling a resumption of the uptrend. Bullish divergences have also formed.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest Resistance Levels:

R1 – 1.3489

R2 – 1.3550

R3 – 1.3611

Trading Recommendations:

The GBP/USD currency pair may resume its uptrend. The pair has already undergone a sufficient correction, and over the medium term, Trump's policies are likely to continue putting pressure on the dollar. Thus, long positions targeting 1.3611 and 1.3672 remain relevant as long as the price stays above the moving average. If the price moves below the moving average line, minor short positions may be considered on purely technical grounds with targets at 1.3402 and 1.33. Occasionally, the U.S. dollar shows corrective movements, but for a trend-based strengthening, evident signs of the end of the global trade war are needed.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.