Trade Review and Recommendations for the Euro

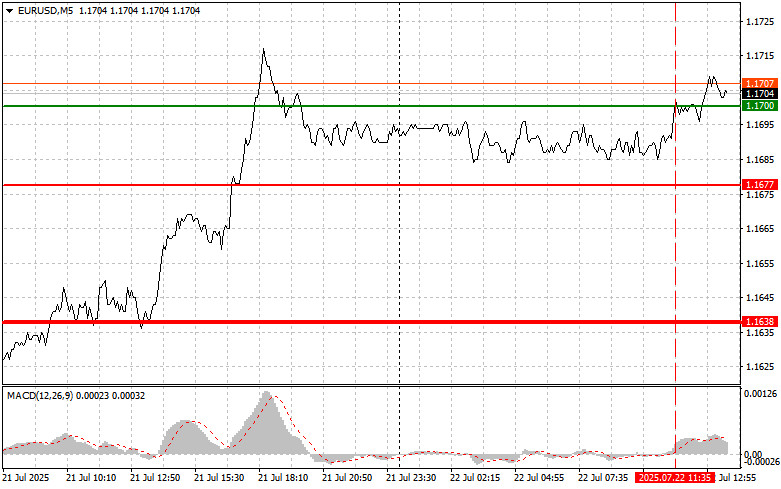

The test of the 1.1700 level coincided with the MACD indicator having already moved significantly above the zero mark, which limited the pair's upward potential.

The absence of key economic data undoubtedly supports the euro's growth, but this effect is no longer as strong as before. Yesterday's bullish impulse, driven by expectations of the ECB ending its accommodative monetary policy, has largely faded. Market sentiment still leans toward the view that the European Central Bank's dovish stance will continue to weigh on the euro, despite short-term optimism. Geopolitical factors, including tariffs, remain a negative influence on the outlook for the euro.

During the U.S. session, market participants will focus on the Richmond Fed Manufacturing Index and a speech by Federal Reserve Chair Jerome Powell. These events will attract close attention from investors looking for signals regarding the Fed's future monetary policy trajectory. While the Richmond Index is regional, it may offer insights into the health of the U.S. manufacturing sector and inflation trends. Encouraging data could reinforce confidence in economic stability. However, Powell's speech is clearly the main event. The market will closely analyze his comments to assess the Fed's readiness to cut interest rates further and the expected duration of current levels. Particular attention will be paid to his assessment of the current economic conditions, inflation forecasts, and risks related to slowing growth.

Hints of a more dovish Fed stance could trigger a decline in the U.S. dollar. On the other hand, if Powell emphasizes a strong commitment to fighting inflation even at the cost of economic slowdown, EUR/USD could fall.

For intraday strategy, I will focus mainly on implementing Scenario #1 and Scenario #2.

Buy Signal

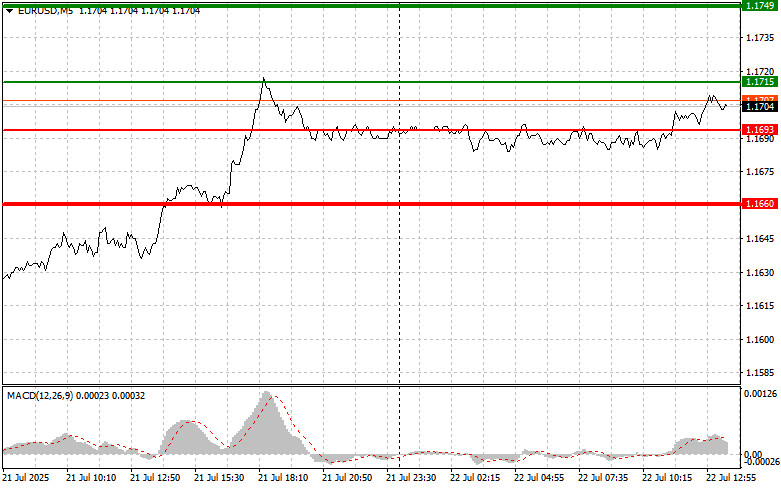

Scenario #1: Today, buying the euro is possible if the price reaches the level around 1.1715 (green line on the chart), with a target of 1.1749. I plan to exit the market at 1.1749 and open a short position in the opposite direction, expecting a 30–35 point correction. A strong rally in the euro today is likely only if the Fed signals a dovish stance. Important: Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1693 level while the MACD is in the oversold zone. This would limit the pair's downward potential and could lead to a reversal to the upside. The expected targets are 1.1715 and 1.1749.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches the 1.1693 level (red line on the chart), targeting 1.1660. I will then consider buying in the opposite direction, expecting a 20–25 point rebound. Selling pressure on the pair could return if Powell maintains a hawkish tone. Important: Before selling, make sure the MACD is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the euro if the price tests the 1.1715 level twice in a row while the MACD is in the overbought zone. This would limit the pair's upward potential and likely trigger a reversal to the downside, targeting 1.1693 and 1.1660.

What's on the chart:

- Thin green line – Entry price for buying the instrument

- Thick green line – Suggested Take Profit level or profit-taking area, as further growth above this level is unlikely

- Thin red line – Entry price for selling the instrument

- Thick red line – Suggested Take Profit level or profit-taking area, as further decline below this level is unlikely

- MACD indicator – When entering trades, use overbought and oversold zones for guidance

Important Note for Beginner Traders:

Forex beginners should be very cautious when deciding to enter the market. It is best to stay out of the market before major economic reports are released to avoid sharp price swings. If you do choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you're not practicing proper money management and trading large volumes.

And remember: successful trading requires a clear trading plan like the one provided above. Spontaneous decision-making based on current market fluctuations is generally a losing strategy for intraday traders.