On Thursday, the EUR/USD currency pair showed a minor upward correction that does not impact the current technical picture. The upward retracement was only 50–60 points, and the price remains below the moving average line, while the CCI indicator did not enter the overbought territory. Therefore, we still expect the pair to continue its decline, which, according to our estimates, should reach at least the 1.05 level, ideally targeting 1.02. We continue to emphasize to traders that the euro has no reasons for growth, and all upward movements in the last two months have been corrections against the stronger downward trend earlier. Thus, according to all the principles of technical analysis, the pair should continue to decline.

We also remind you that the CCI indicator entered overbought territory three times. As we mentioned before, this is a strong signal for a trend reversal, especially when formed during a corrective movement. Of course, if the macroeconomic statistics in the US continue to disappoint, it will be challenging for the dollar to strengthen. However, macroeconomic data from the European Union is not any better. The ECB practically openly talks about the lack of a need to raise interest rates, which could have supported the European currency.

So, what do we have in the end? The euro is overbought, completing the correction within the downtrend; the CCI indicator points down, and there is no reason for the euro to rise. In the 24-hour timeframe, the pair has dropped to a critical line, and now it needs to overcome it. Just below lies the Senkou Span B line. Overcoming these two strong lines may pose challenges, so the pair may pause for some time. Today, everything will depend on the macroeconomic statistics from across the ocean. It can trigger a decline in the dollar or an increase, during which these lines will be easily overcome.

Uncertainty in the American session

As mentioned earlier, even if Non-Farm Payrolls and unemployment disappoint traders today, the overall trend and forecast will not change. The US economy has been predicted to enter a recession for over a year. Most forecasts now suggest that the Federal Reserve will have to lower interest rates next year as economic growth slows. Therefore, key macroeconomic indicators will also fall. This is a significant reason for the dollar's decline. Still, once again, we want to emphasize that the state of the European economy is no better, and the high ECB interest rate will also exert pressure on the economic growth of the European Union.

Thus, the euro has no advantage and will not have any. Like the Federal Reserve, the ECB will have to start easing monetary policy next year, which is also a bearish factor for the euro. As for today, everything is simple and obvious. If the two key reports (Non-Farm Payrolls and unemployment) show better values than expected by the market, then an increase in the dollar should be expected. If worse, then a decrease. If one report is better and the other is worse, then Non-Farm Payrolls will have priority, and the pair may move in one direction first and then in the other, covering approximately the same distance. Unfortunately, it is currently impossible to say in which direction and how the pair will move during the American trading session. Therefore, one should be prepared for any developments.

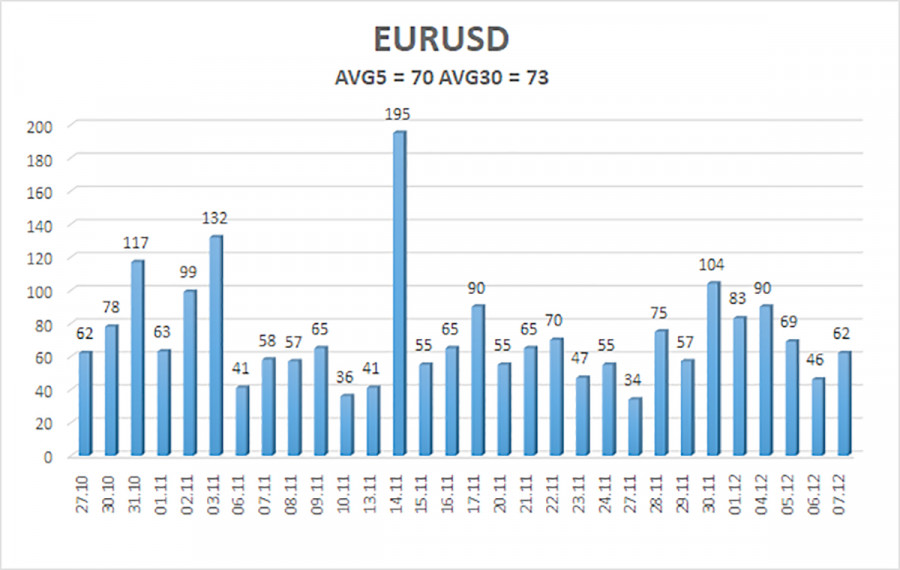

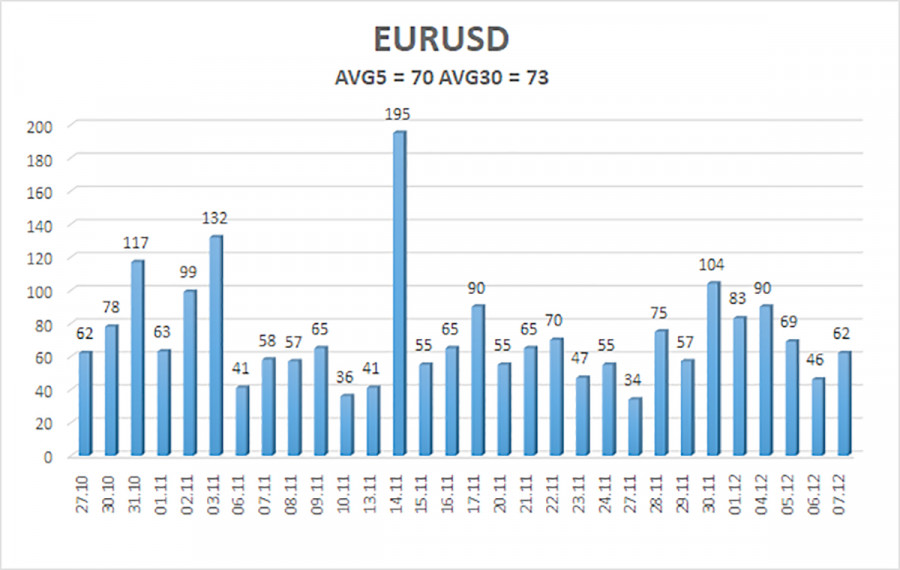

The average volatility of the euro/dollar currency pair for the last five trading days as of December 8 is 70 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0719 and 1.0859 on Friday. A downward reversal of the Heiken Ashi indicator will indicate a resumption of the downward movement.

Nearby support levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearby resistance levels:

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading recommendations:

The EUR/USD pair remains below the moving average line, allowing traders to continue considering short positions with targets at 1.0742 and 1.0719. Currently, we see no reason for the pair's decline to stop. As for buying, they can be considered when the price consolidates above the moving average or when strong signals are formed within the 24-hour timeframe. Targets are 1.0864 and above. Today, the pair may show divergent and highly volatile movements during the American trading session, as the macroeconomic background will be very strong.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought territory (below -250) or oversold territory (above +250) indicates an impending trend reversal in the opposite direction.