In this article, we will explore what cryptocurrency market capitalization is and how it can help determine which projects are worth investing in and which are not.

Market capitalization reflects the stability of a crypto asset. A cryptocurrency with a higher market cap is generally more reliable than one with a lower market cap. Low-cap assets are more susceptible to market news and large transactions.

We will examine what market capitalization means in the world of crypto and how it can guide investment decisions.

Market сapitalization

Market capitalization is a financial metric used to assess the value of an asset. In the stock market, it is commonly used to evaluate traditional securities. In the cryptocurrency industry, the concept is applied similarly, though with some specific nuances.

Market capitalization helps us estimate the value of tradable securities in circulation. It is calculated by multiplying the number of shares (or coins) in circulation by the current price of one unit.

For example, if 50 tokens are in circulation and each is worth $5, the market cap would be $250.

In traditional investing, analyzing stocks and bonds involves looking at financial fundamentals, such as price-to-earnings ratios, liquidity, and a company’s growth prospects. However, crypto projects typically do not disclose detailed financial data, which makes publicly available metrics like market capitalization all the more important.

With market cap, we can get a quick sense of how much value a cryptocurrency holds in the eyes of its users.

Cryptocurrency сapitalization

Cryptocurrency market capitalization is an indicator of an asset’s stability. A higher-cap crypto asset is more likely to be stable and less prone to sudden price swings than one with a lower cap.

Low-cap cryptocurrencies are highly sensitive to news and major transactions. This is common in the crypto space, as the market is known for its high volatility.

Holders of low-cap assets often suffer from the actions of large traders. If “whales” buy or sell large amounts at once, it can significantly affect the asset’s price.

In contrast, major assets like Bitcoin or Ethereum are harder to influence due to their large market capitalization. Their higher cap makes them more resilient and less vulnerable to price manipulation.

Market cap shows how many coins are in circulation and at what price, but it does not reveal who holds these coins. They could be in the hands of large investors, small traders, or even the project’s own developers.

This is important because investors who hold large quantities of a coin can easily sway the price direction.

Moreover, some project teams retain a large portion of their tokens, allowing them to control the project’s development and artificially create the appearance of strong support.

Comparing cryptocurrency market capitalization with major companies

Before investing in any asset, it is important to pay attention to its market capitalization, as it can reveal a lot about the project itself.

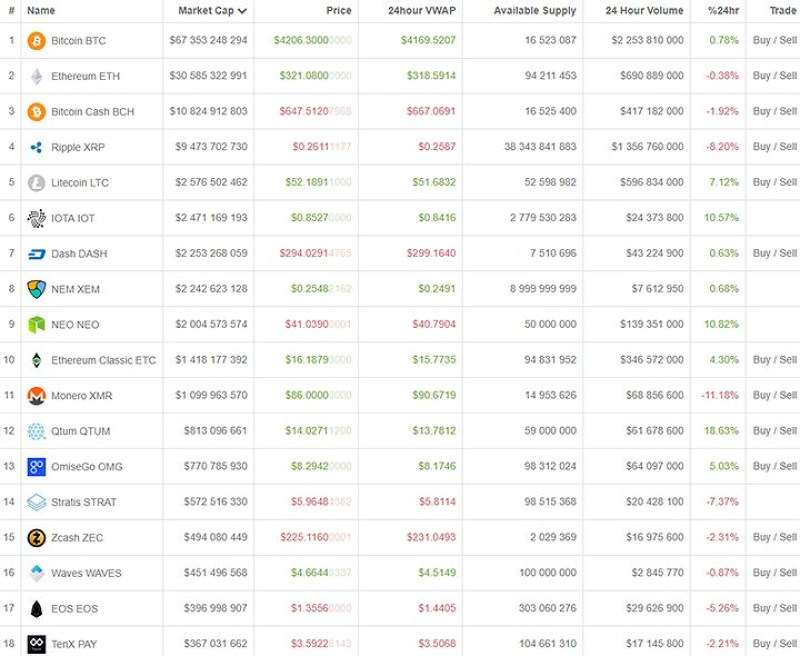

Currently, Bitcoin is one of the most reliable and largest crypto projects and has the highest market capitalization. It accounts for roughly 60% of the total market share, which is several times more than Ethereum, another major project. The gap between Bitcoin Cash and Ripple (XRP) is also significant, even though Ripple itself has a substantial market cap.

As cryptocurrencies gain popularity, even new projects can quickly see their market capitalization grow. More and more coins now reach market caps of $20 million or more, but Bitcoin still remains the dominant force. As a result, the majority of market capital is concentrated in Bitcoin and a handful of other large-cap assets.

Bitcoin’s current market cap stands at $1.30 trillion, which is a staggering figure for a virtual currency. But let’s compare that to some of the world’s biggest companies—Facebook (Meta) has a market cap of $599.32 billion, and Apple sits at $1.044 trillion.

This comparison highlights just how massive Bitcoin has become, even outpacing major corporations, further underlining its importance in today’s financial world.

Why is crypto market capitalization calculated?

Market capitalization is one of the key indicators of how popular and valuable an asset is among users. Generally, coins with higher market caps are in greater demand than those with lower caps. However, there are exceptions. For example, Ethereum tokens trade at much lower prices than Bitcoin, yet they remain highly sought after by users.

To better assess a project's popularity, investors use the following classification:

- Large-cap assets: market cap over $10 billion

- Mid-cap assets: market cap between $1 billion and $10 billion

- Small-cap assets: market cap below $1 billion

Let’s also note that total market capitalization refers to the combined value of all coins in circulation at the current market price.

Market capitalization allows investors to compare assets. Generally, investing in a high-cap cryptocurrency is considered less risky, as its price is less influenced by news cycles and short-term events.

However, market cap is only one of many metrics used to evaluate a project’s potential. A full assessment should include other tools and indicators as well.

What factors influence market capitalization?

Many factors influence the market capitalization of a cryptocurrency. Understanding them can help you better read the market mood and evaluate a project's future prospects.

Tokenomics

Tokenomics shows how many tokens are in circulation, how many are yet to be released, and how they will be distributed. Developers must clearly demonstrate the role their token plays in the project’s development.

Each project controls the token supply through mechanisms like token burning. This reduces the number of tokens in circulation, which directly affects market capitalization. If demand increases while supply remains limited, the token price rises, boosting the overall cap.

Circulating supply vs. total supply

This ratio helps us understand what percentage of tokens are actively traded. A higher circulating supply often signals greater investor interest, which can lead to a higher market cap.

Regulation

While cryptocurrencies are largely unregulated, certain legal developments can impact market cap. For example, legalization can increase investor confidence and lead to growth. On the other hand, regulatory bans or restrictions may raise doubts about the asset's future and reduce demand.

Market sentiment

Investor emotions also play a major role. Fear can cause mass sell-offs, decreasing market capitalization. Conversely, greed can trigger aggressive buying, inflating the market cap.

Technical development

If a project is actively improving—enhancing security, launching blockchain upgrades, or expanding its ecosystem—users are more likely to trust and invest in it. Frequent hacks or technical failures, however, can damage investor confidence.

Projects that support smart contracts, DeFi, or NFTs often attract more attention.

Additionally, many investors look at whether large institutions have backed the project, which can influence investment decisions.

Exchange listings

Finally, the exchange where a coin is listed also affects demand. Coins listed on major, reputable exchanges are purchased more actively than those on lesser-known platforms. A user-friendly interface is also important, as it can lead to increased adoption and, ultimately, higher market capitalization.

What does crypto market capitalization influence?

Earlier, we looked at the factors that affect market capitalization. Now, let’s explore what market capitalization influences and how it can help you choose which crypto asset to invest in.

- Cryptocurrency adoption

Assets with high market capitalization are increasingly being used as financial instruments. They are commonly employed by users for various transactions. - Volatility

Market capitalization has a direct impact on volatility. The higher the market cap, the less volatile the asset tends to be. This gives investors greater confidence in the stability and predictability of the asset, making it a less risky investment. - Investor confidence

A high market cap attracts investors and increases their trust in the asset. A large cap often indicates that the coin is reliable and stable, which is crucial for investment decisions. - Recognition and visibility

High-cap assets are typically well-known and frequently featured in the news. This visibility helps attract new investors and increases the liquidity of the cryptocurrency.

Types of market capitalization

Cryptocurrencies come with different market caps, and they are typically divided into three categories. Let’s look at each in more detail:

Low-cap coins

Assets with a market capitalization of less than $1 billion are considered low-cap. These coins are often not very popular and rank lower in the crypto market.

So why do some investors prefer low-cap coins? Because of their potential for growth and higher returns. You can buy these coins at a low price and wait for them to rise in value before selling for profit.

However, there are risks involved:

- These assets are highly volatile,

- Their prices can swing suddenly,

- And they are sensitive to market news and rumors.

This creates a riskier and less predictable investment environment.

Orbit, Bella Protocol, and Flamingo are examples of coins with low capitalization and limited popularity.

Mid-cap coins

These are assets with a market cap ranging from $1 billion to $10 billion. Most altcoins fall into this category. They are relatively well-known and in demand, often ranking between 20th and 50th place on market listings.

Mid-cap assets carry moderate risk, which is why many investors prefer them. They are also known for their rapid price growth, offering good profit opportunities. During a bull market, mid-cap assets can surge by 50% or even 100%.

However, they are still somewhat volatile, and not all mid-cap coins are reliable investments.

Pepe, Kaspa, and Aptos are strong examples of mid-cap cryptocurrencies.

High-cap coins

These are assets with a market cap above $10 billion, usually found at the top of crypto rankings. These projects have been around for a while and have already earned investor trust.

High-cap coins tend to be very stable, less affected by news or short-term market changes.

Because of this stability, they are a go-to choice for many investors.

We recommend beginners consider investing in high-cap assets, as they are well-established and less volatile, making them a safer and more stress-free investment option.

Bitcoin, Ethereum, and Tether are popular examples of high-cap cryptocurrencies with strong reputations.

Deflationary cryptocurrency

Many have heard the term "deflation." In economics, it refers to the removal of excess money from circulation to increase its purchasing power.

In the context of cryptocurrency, deflation is the process of reducing the number of tokens in circulation, thereby increasing their value. This is achieved in two ways:

Developer buybacks and burning: Developers purchase some of their own tokens and send them to an inactive wallet. This removes those tokens from circulation, effectively increasing the value of the remaining ones.

Transaction fees and burn mechanisms: Fees collected from users are burned during transactions, permanently taking those tokens out of circulation.

To better understand deflationary tokens, it’s important to grasp the concepts of inflation and deflation: inflation causes prices of goods and services to rise; deflation is the opposite.

Why does this happen? When more tokens enter circulation, their value tends to decrease due to abundance. People need to pay more to acquire goods or services—this is inflation. Conversely, deflation occurs when the money supply remains constant or decreases while goods and services’ prices fall.

BNB is a prime example of a deflationary cryptocurrency. Its initial supply was 200 million tokens, but by the end of 2022, about 40 million had been burned. Later, developers reduced the total supply to 100 million tokens—half of the original issue—to prevent price drops.

ETH (Ethereum) is also deflationary. It burns more tokens through transaction fees than it issues. This mechanism was introduced after the “Merge” update, which modified the consensus algorithm and shifted network management to validators.

How to obtain cryptocurrency

Airdrops

Many projects distribute free tokens to users, typically as a reward for engaging with the product. To receive tokens, users might need to complete tasks like making token swaps or participating in social media campaigns.

Cryptocurrency and marketing

Bloggers, news sites, and ordinary users often earn crypto via affiliate marketing. Companies provide personalized URLs. When people click and make purchases, referrers earn commissions.

Payment structures vary: some platforms offer a percentage of each purchase. Others pay a fixed amount per new user.

Major exchanges (e.g., Coinbase) reward users when referred individuals sign up and fund their accounts.

If you have a large audience, this can generate significant earnings.

Market capitalization: top 5 coins

The crypto market today is vast and expanding. Here are the top five coins by market cap:

- Bitcoin: the market leader

- Ethereum: a leading altcoin

- Ripple (XRP): a platform for global transactions

- Litecoin: optimized for higher throughput

- Bitcoin Cash: a Bitcoin fork

Bitcoin

Launched in 2009, Bitcoin was the first cryptocurrency and inspired many subsequent projects. Its decentralized nature allows fast, peer-to-peer transactions without intermediaries and with minimal fees.

Current price: ~$60,000

Past price: ~$28,000

Most analysts forecast continued growth, but the future remains uncertain.

Ethereum

Ethereum is the second-largest crypto by market cap and a foundational platform for decentralized applications and smart contracts. Many tokens and DeFi/NFT projects are built on Ethereum.

Price: ~$3,500

Market cap: ~$426 billion

It holds the second spot after Bitcoin.

Ripple (XRP)

Ripple facilitates fast, cross-border transactions and is backed by Ripple Labs, a recognized leader. It rivals traditional systems like Western Union and SWIFT.

Price: ~$0.48

Market cap: ~$55 billion

Litecoin

Created to address some of Bitcoin’s limitations, Litecoin offers fast transactions and robust security via encryption.

Price: ~$73

Market cap: ~$5.5 billion

Bitcoin Cash

A fork of Bitcoin, Bitcoin Cash introduces larger block sizes—8 MB compared to Bitcoin’s 1 MB—and adjusts mining difficulty every 6 blocks.

Price: ~$1,287.32

Market cap: ~$19 billion

Conclusion

Market capitalization is one of the most important metrics in assessing a cryptocurrency. It represents the total value of all circulating coins and serves as an indicator of the coin’s market strength. This parameter should be one of the primary considerations when choosing a cryptocurrency investment.

Back to articles

Back to articles