The EUR/USD currency pair declined over the past two trading days. The Heiken Ashi indicator did not turn upwards even once, so the decline is relentless. We want to draw traders' attention to the fact that there have been several negative news releases from the United States this week. In particular, the ADP and JOLTs reports have already been disappointing. While these are not the most crucial labor market reports, the market ignored them. Does this situation remind you of anything? The pair is moving strictly in one direction, often ignoring reports that do not align with the main direction of movement. It is precisely through this pattern that the European currency formed its last surge in growth.

We have repeatedly mentioned that the rise of the European currency is unfounded. The fact that several important reports in the U.S. failed cannot push the pair up by 400–500 points. Yes, the euro currency should have corrected upwards after a sharp decline a few months ago, but still, the correction cannot be equal to the trend. Also, one should remember the triple overbought condition of the CCI indicator. We warned that the decline might not start immediately after these signals were formed. The CCI indicator usually warns of an upcoming trend reversal or correction. As we can see, the correction has started, and now it may take the form of a full-fledged trend, as we anticipate.

It is also worth noting that despite the pair's decline by 250 points in just a few days, the CCI indicator has yet to enter the oversold territory. Therefore, we have no signals to indicate the end of the movement to the south. We may see a strong upward correction tomorrow, but we want to remind you that the JOLTs report, from which some traders could infer weakness in the labor market, was released for October. ADP and nonfarm payroll reports almost never correlate with each other. Thus, weak JOLTs and ADP reports do not mean Nonfarm Payrolls and unemployment will also be weak.

In principle, the Nonfarm Payrolls indicator has had a downward trend over the past year. It cannot be said that it has fallen to negative or zero values; the U.S. economy continues to create new jobs steadily. However, the Federal Reserve's interest rate pressures everything except economic growth. Thus, the slowdown of the Nonfarm Payrolls indicator is not an unexpected event. Since Nonfarm Payrolls were below expectations last month, we can expect a stronger figure this month. Forecasts suggest an increase of 180,000 in November; this forecast can easily be exceeded. It may also be revised upward based on the previous report.

As for unemployment, it may increase by another 0.1%, but unlikely more. The market's main focus will be on Nonfarm Payrolls, but now, one factor can override any statistics. The market has been buying the dollar recently, so even weak data from across the ocean may have a manageable impact on the U.S. currency. If the reports disappoint, we will likely see a sharp rebound, but by the end of Friday, quotes may return to their original positions and continue to decline next week. It should be remembered that insignificant meetings of the ECB, Bank of England, and the Federal Reserve are approaching. None of the central banks will raise the rate, so all meetings will be routine. Market reactions can only be triggered by statements from the heads of central banks, but hopes for that are extremely low, as their recent statements have not contained anything new. Therefore, the market sentiment will not be influenced by fundamentals.

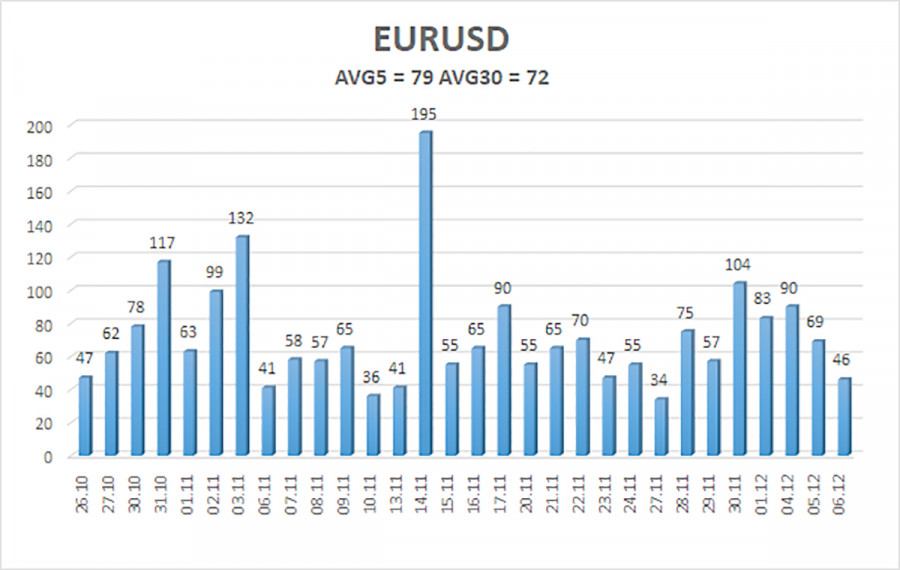

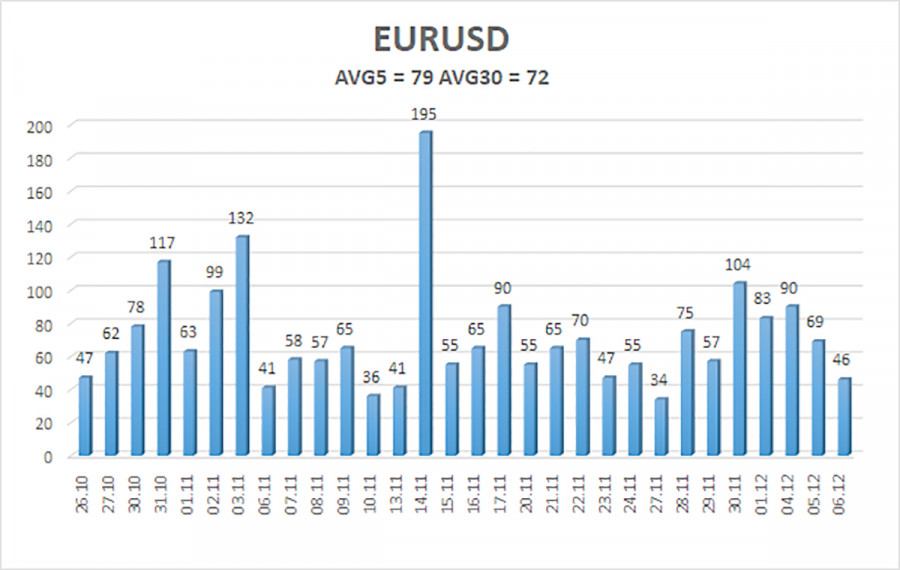

The average volatility of the EUR/USD currency pair over the last five trading days as of December 7 is 79 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0684 and 1.0842 on Thursday. An upward reversal of the Heiken Ashi indicator will indicate a reversal of the upward correction.

Nearest support levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading recommendations:

The EUR/USD pair has settled below the moving average, allowing traders to stay in short positions with targets at 1.0684 and 1.0620 until the Heiken Ashi indicator reverses upwards. We see no reason for the pair's decline to stop. As for buying, they can be considered when the price consolidates above the moving average or when strong signals are formed within the 24-hour timeframe. Targets are 1.0986 and higher.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and direction in which trading should be conducted.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold territory (below -250) or overbought territory (above +250) indicates an approaching trend reversal in the opposite direction.